It all started with this document by Satoshi Nakamoto, the legendary inventor of Bitcoin, as an electronic peer-to-peer payment system published on October 31, 2008, and made available to the world. Whether Satoshi is a person or a group of people is still hotly debated today. However, this should not be the topic of this post. Every crypto enthusiast is advised to read this whitepaper in the course of his crypto journey.

Be it just to be there, to understand a bit more, or to broaden one’s developer, investor, or fan horizon, this 8-page document is in my opinion a standard and should be read, studied, or just skimmed at least once in one’s career.

Now, those who go to the site bitcoin.org will be able to download the document in countless languages and read it. Therefore, the idea of this entry is not a 1:1 transcription, but a short appreciation of this revolutionary idea of Bitcoin. Likewise, there are thousands if not millions of such entries on the Internet, and yet one of these so-called “Genesis Blog entries” is the perfect opportunity for our blog (Bitcoin connoisseurs will understand this allusion) to start our own posts.

But before we dive into the topic, let’s talk about our own business. We at Cryptonerdian are just huge fans of the crypto world and are neither professional elite programmers nor “millionaire investors from the beginning”, nor are we the all-knowing scientist or the oracle with the crystal ball in its hand.

No, we are simple people who have gained interest in the exciting world of crypto through their hobbies years ago, and coupled with our thirst for knowledge and passion for the Internet and blogging like to share our findings.

Therefore, dear reader, we always ask you for critical questioning of our articles and also not to rely 100% generally on what we or others publish on the Internet. Of course, we always try to work out the topics we publish with the best knowledge and conscience. Finally, however, we are only individuals who follow their daily obligations, and own thoughts and share them and thus can also be mistaken. With this important message for us, we dive into the whitepaper.

Table of Contents

ToggleWhitepaper of Bitcoin

If I’m honest when I first read through the whitepaper, not much happened because my knowledge was not that great to even begin to understand what was being explained here. I am 100% sure that I was not the only one, but one of a large number of people who are interested in this topic but have no clue what it is about. This was in 2013/2014 when I came into the context of my bachelor thesis in computer science on Bitcoin as a possible means of payment on the Internet.

At that time the coin was worth around $335 and I remember it very well as I was thinking of buying a few to be closer to it. Well, if I had known that it was worth around 40,000 today, I would have done the same. Hahaha, yeah right I’m one of those who were interested but didn’t quite believe it. Well during the years I was taught better and today I am one of the converted cryptocurrency fans.

When you consider that a revolutionary idea was published in a white paper of 8 pages, you can just imagine how much knowledge is in it. I had to read one or the other book to get a better picture, but the whitepaper had generated so much hunger in me to read deeper into the matter. Well, I am not a software developer and also not a cryptographer.

As a project manager in the financial messaging area, this topic nevertheless grabbed me because of the future possibilities. Actually, the whitepaper is not that difficult to read to understand the basic idea, but then the topic is not necessarily understood in its entirety.

The document is divided into the following chapters:

Abstract

- Introduction

- Transactions

- Timestamp server

- Proof-of-Work

- Network

- Incentives

- Reclaiming Disk Space

- Simplified Payment Verification

- Combining and Splitting Value

- Privacy

- Calculations

- Conclusion

As mentioned before, this is not intended to be a 1:1 transcript as the document is freely available for download in countless languages at bitcoin.org

In this first part we will go through Abstract, introduction and transactions.

Abstract

Now in the abstract, Satoshi talks about the idea of a future electronic payment method that allows a payment to be made directly from the sender to the recipient without having to rely on a trusted third party acting as an intermediary with the necessary infrastructure. This so-called trusted third party is also responsible for eliminating the problem of double-spending, which is particularly prevalent in the digital world. This is ensured by using a decentralized peer-to-peer network.

The network gives the transactions a timestamp and the application of proof-of-work validates the authenticity of a transaction. To put it briefly, the proof of work consensus is nothing more than the calculation of a hash value by means of a complicated computational task. But more on this later.

The concatenation of this hash-based mode of operation serves not only to prove the authenticity of the transactions but also to prove that the longest chain comes from the largest pool of CPU power. Satoshi mentions also already the defense against a 51% attack (But more about this later).

The network itself requires only a minimal structure, also it is possible that a so-called node can leave or re-enter the network at will without hindering the correct work.

Annotation: Very interesting is the mention of Satoshi that this payment system does not require trusted third parties. These are mostly financial institutions such as banks, clearinghouses, and central banks that control the entire payment transactions nationwide as well as across countries. This can be illustrated with a simple example. Let’s say person A in Italy wants to buy something from an online store in Germany. Of course, there are several means of payment that can be used here, most of them are cashless digital payments.

Let’s assume that this person makes a payment by bank transfer, then person A instructs his house bank by means of perhaps his own online banking to make this transfer of 20 € to the account Of the online store and its bank. Now, this seems to be very simple, but behind the stage, many intermediate steps happen which are not known to person A and also to the online store B, because they entrust the third instance, the financial institution, with the further procedure.

Let’s go back to person A who has instructed his bank to execute the payment. The bank will now send the money to the European Central Bank via its own national bank. This will send the money and the national bank in Germany and the national bank in Germany will then credit the money to the bank and the account of the online store. In this case, this payment goes through the Target 2 payment system.

Now, most likely the purchase via credit card would be more logical here since they guarantee both the buyer and the seller certain protection which is ensured by the credit card company and the banks that are connected.

But also here the third trusted entity is the credit card company, the credit card issuer, and the financial institution involved. Of course, there are countless examples that could be mentioned here and we leave it like this for the further explanations

Further interesting mention refers to the double-spending problem. Just imagine that person A goes shopping in a store and pays cash. At the moment that person A hands over the 20 € cash to person B he cannot spend the same 20 € for another store i.e. this payment transaction is unique. In addition, we all know that banknotes contain certain security features that do not allow the same banknote to be duplicated or forged in any number of ways.

This is also ensured by the third trustworthy authority. In the example of cash, this is the mint or the central bank that produces the cash (or at least commissions the production).

Now with the digital was so-called book money it concerns however only so-called assets which change the owner. If you compare this with a PDF document that can be copied and distributed at the same time as often as you like and thus loses its uniqueness in one fell swoop, you realize the problem if there is no trustworthy third party that has this monitoring function.

Now Bitcoin ensures all this without the need for a third party to take over this function and this means that actually the entire payment transaction can be carried out much more efficiently in terms of time and also a lot cheaper.

1. Introduction

Although this system works quite well for most transactions by relying on the financial institution as a trusted entity, it also has its weaknesses. This means that completely irreversible transactions are not really possible, as the financial institution has to act as an intermediary in the event of a dispute. The reversal of transactions naturally creates a certain level of trust, but this is also associated with correspondingly high transaction costs. Sellers or buyers can never completely count on the prevention of fraud on the part of one of the two parties, even if a financial institution is interposed as a third trustworthy authority.

Apart from cash payments, there is no mechanism for payments via a communication channel today which can be executed without this trusted party. Now, an electronic payment system based on cryptographic proof instead of trust would allow both parties to make payments to each other. The financial institution as a trustworthy body would therefore no longer be needed.

The seller would be protected from fraud by a transaction that cannot be revoked by calculation. On the other hand, the buyer would be protected against fraud by standardized trust mechanisms that can be easily implemented. A timestamp could provide mathematical proof of the chronological order of transactions and would thus counteract double-spending.

Annotation: We have a very good example with payment via direct debit or also Via credit card. Here, the buyer has the possibility at any time within a certain period of between 30-60 days to submit an objection to his bank. If something like this happens then the bank must first and foremost credit the buyer, i.e. the debtor, the money back to his account immediately without any language.

Afterward then between the banks and the credit card enterprises and the salesman, the clarification takes place whether this payment or this payment collection of the right is or evenly not. In this case, the financial institution takes its role as an intermediary. As far as the escrow mechanisms are concerned, I’m not quite sure if Satoshi has already mentioned the smart contracts, which are a big topic on Ethereum, for example.

2. Transactions

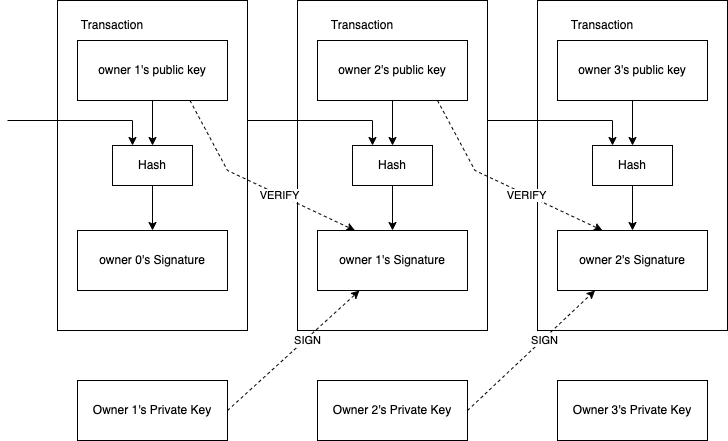

Satoshi defines an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and appending this to the end of the coin. The recipient of payment can then verify these signatures. For better understanding, I have made a copy of the drawing on the White Paper and added it here.

To prevent double-spending without the use of a trusted entity, all transactions must be made public. In addition, it requires a system with which all participants agree on a single course of the order in which the transactions arrived. The payee needs proof that at the time of each transaction, the majority of the network agrees that they received it first.

In the next part The Bitcoin Whitepaper Part 2 we will go through the Timestamp server, Proof-of-Work, Network, and Incentives.

The original whitepaper about Bitcoin can be downloaded in different languages here: bitcoin.org