Cardano belongs to the third generation of blockchain-based projects and differs in many respects from the other projects known today, not only in the approach to development. But more on this later.

Crypto projects now exist in large numbers, either as stand-alone achievements, as projects based on existing technology that bring about improvements and adaptations, or even pursue utterly new use cases and goals.

The following article is based on the IOHK video by Charles Hopkinson. In this video, he gives an overview of Cardano. While it was shown 4 years ago, it is an ideal starting point to understand the idea and philosophy behind Cardano.

Table of Contents

ToggleCardano 3rd Generation Cryptocurrency

While Bitcoin is the first generation of blockchain projects, Ethereum is the second generation.

The first generation was not really designed to map the contractual aspects behind a transaction.

Ethereum was created as the first second-generation blockchain and took into account the terms and conditions that transactions between parties can entail.

Cardano takes care of the 3 topics

- Scalability

- Interoperability

- Sustainability

and tries to solve them by inheriting the lessons learned from Gen 1 and 2 projects and by adding new concepts and specifications to Cardano.

The following principles are applied. Every scientific solution and approach always goes through a peer review to ensure high quality and implementation as a high-assurance code.

For a better understanding, the terms should be looked at again in more detail.

Scalability

There are several points that need to be taken into account and put into context. On the one hand, it is about the number of transactions per second that are processed (TPS). However, this again cannot be considered in isolation. The more TPS, the greater the network bandwidth must be. This could well require several 100 MB to GB of network resources as the number of users increases.

The third point in this context relates to the data scale. A blockchain is here to store all transactions ever made, regardless of whether they are significant or not. Every transaction ends up in a log and the more transactions processed per second, the more data is created. A blockchain can grow from megabytes to exabytes.

Now for a replicated system where the security is based on each node having a copy of the blockchain, one can imagine that such a size is not manageable for normal consumer devices. Who could afford hardware that can manage exabytes of data in a blockchain?

Mindmap below: You can click on the graphic below and it will be opened in a new tab

This problem is solved by Cardano bringing more and more users to the network, thus increasing the number of transactions and making more network resources available. This may result in more data storage overall without compromising the security model.

TPS

The Ouroboros Proof of Stake consensus mechanism can significantly increase TPS in addition to high security. This modular and future-proofed designed mechanism is very efficient. Compared to Bitcoin, the blocks can be calculated with a fraction of the computer resources, thus keeping the costs low.

However, the really relevant fact for the TPS in the context of scaling is that the Consensus mechanism allows multiple blocks to be held in various chains. Since the costs are also low, the idea of a consensus mechanism across numerous blockchains is worthwhile. Through Ouroborus, the calculation of blocks across multiple blockchains could be done in parallel simultaneously and transactions could be partitioned accordingly. This enables a higher TPS as well as a corresponding scaling.

For reference, when Bitcoin was worth USD 5000, network maintenance cost USD 300,000 per hour!

Network

Another important point to ensure scalability is the network. To move large volumes of data at the same time, up to 100,000 transactions per second, a homogeneous network topology cannot be maintained. To achieve this a new technology called RINA (Recursive Internet Network Architecture) will be implemented, according to Charles Hoskinson (youtube video: IOHK|Cardano whiteboard; overview with Charles Hopkinson). RINA is a new type of structuring network that uses policies and engineering principles to form a heterogeneous network. This network guarantees the same privacy, transparency, and scalability as the TCP-IP protocol but provides a way to naturally tune and configure Cardano to increase TPS while seamlessly connecting and operating with TCP-IP.

Data

According to Hoskinson, data scaling is a major challenge. One important aspect is that not everyone needs all the data all the time. Techniques such as pruning, subscriptions, and compression substantially reduce the volume of data a user needs if they are used intelligently. In addition, partitioning allows the user to hold only one chunk of a blockchain. Cardano tries to solve the problem of data scaling without sacrificing security. This also includes the idea of sidechains that can represent blockchains in a compressed way while still providing a high level of clarity about the correctness and validity of transactions. Bear in mind that it is precisely the verification and storage of the necessary data regarding transactions in a blockchain that produces huge volumes of data over time.

Interoperability

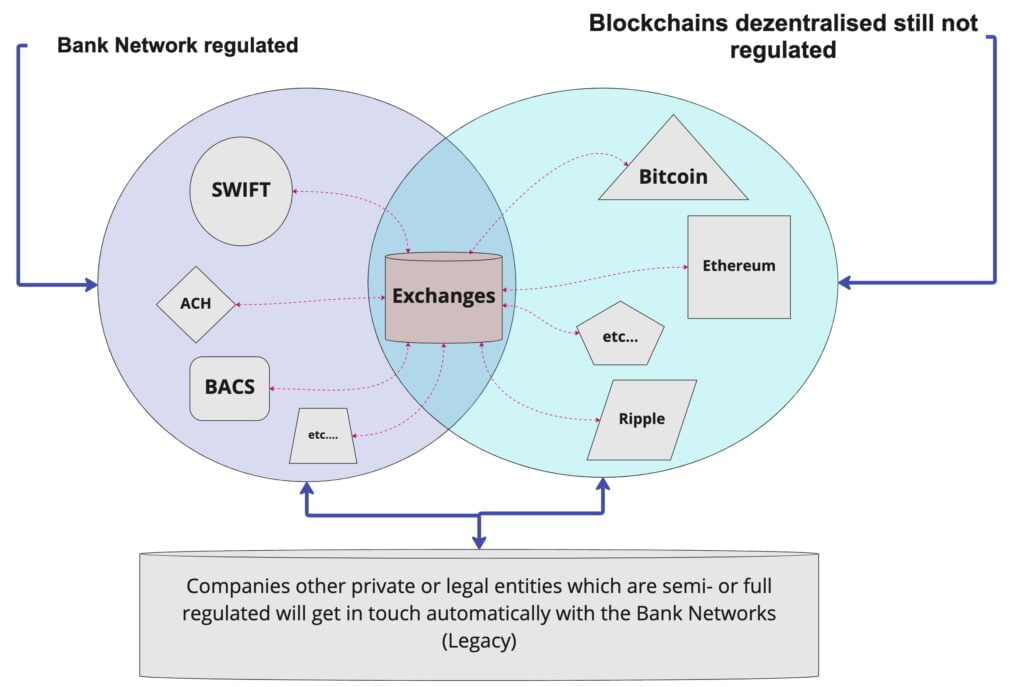

There are many different networks like Bitcoin, Ethereum, and Ripple on the one hand, but also legacy networks traditionally used by banks like SWIFT or clearing systems like ACH. The problem today is that all these different networks have their own system language and business logic and rules.

As a result, networks like Bitcoin and Ethereum have difficulties understanding each other today. Such interoperability gets even more difficult with legacy systems, which have their own requirements for metadata and attribution to transactions.

Regardless of how decentralized the individual systems are in themselves, the big problem remains the communication with the other networks. The value will therefore be very fragmented and the real key players are the hubs that enable the transfer of value in the form of transactions between the different networks. These hubs are currently the exchanges (Binance, Kucoin, Kraken, Coinbase, etc…). However, these are also very fragile, as they can be hacked, are subject to different regulations, and represent a kind of centralization. In turn, the current situation grants power to just a small group.

The additional problem that currently exists is that, although on the one hand there is decentralization and freedom of regulation, this advantage disappears into thin air when there is contact with a banking network participant.

Consider that today there is hardly any company that is not linked to the bank via a bank account and is therefore automatically exposed to banking regulations. Thus, an essential advantage that is achieved through a blockchain is dissolved.

On the other hand, due to the lack of compliance, corresponding metadata, and their attribution the banks consider possible partners doing business on the blockchain areas and would like to interoperate with the banks as a high-risk business.

Third-generation cryptocurrencies such as Cardano are able to ensure interoperability and reliability across blockchains and their cross-chain transfers without the need for a trusted third party.

To achieve this, Cardano pursues the concept of sidechains, which structure and compress information from one chain to another in such a way that the legitimacy of a transaction can be proven in an efficient way without the need of holding an entire copy of the respective Blockchain.

The approach of non-interactive proofs of proof of work, which was developed by Cardano, should enable cross-chain interoperability together with the proof of stake setting.

Up to this point, however, interoperability with the banking network has still not been achieved. There are still challenges related to metadata, attribution, and compliance.

Metadata

Metadata is, roughly speaking, the story behind a transaction (the where, when, for what, to whom, etc…).

In the crypto world, metadata is not very well managed and held, but in the banking world, metadata is essential for a wide variety of applications.

Metadata has enormous value. In addition, they are also relevant for compliance issues in the banking world. Consider that payment usually has to pass through a sanction filter before it is executed. A sanction filter searches the metadata for predefined information that could be associated with risk exposure, sanctioned actions, countries, or individuals. Financing criminal activities, arms deals, payments to sanctioned countries, etc…

The problem here is that metadata is something very private and personal. In the world of blockchains, this would mean that such metadata would be stored forever and, above all, transparently.

In this case, there would be a risk that very sensitive data would be reported in the blockchain.

Cardano is trying to find out how the integration of metadata can be implemented in a way that ensures suitability and immutability but also the secure handling of sensitive data in the blockchain (encrypted, etc…).

Attribution

This is about the identity of the participants involved in a transaction. Although strictly speaking this is also metadata, the identity is so important that it should be mentioned separately. This is clearly about the sender and recipient of a transaction.

Adding identities to the blockchain is not the problem. It is rather the challenge of ensuring a web of trust. The identification of users on the Internet is the problem today, which is why passwords are used on the Internet. A big advantage of cryptocurrencies, however, is that their blockchains offer space for cryptographic solutions related to identities.

The aim of Cardano is to offer ways and means to decide individually whether identity information should be provided or not and to secure it accordingly.

Compliance

The terms Know your Client (KYC), Anti Money Laundering (AML) and Anti Terrorist Financing (ATF) appear in connection with compliance. These topics are very well known in the financial institution world and come with many directives and rules that must be observed and implemented.

This has not been considered in the crypto world in this way.

The aim of Cardano is to provide means and mechanisms that allow a participant to provide the necessary data for transactions via the banking networks and also make the banks feel comfortable in processing such transactions. In this way, interoperability can be ensured individually with Cardano, both with the cross-chain and with the banking network.

Sustainability

The question that arises is how to finance the Cardano venture so that it is constantly developed and maintained and new ideas can be implemented cost-effectively. This is accompanied by permanent funding that makes all this possible.

The ideal system is one that includes a treasury. The treasury is capable of printing money and holding it in a decentralized bank account. This decentralized bank account is funded by inflation. This model was first introduced by the cryptocurrency DASH.

Through this treasury account, funding proposals for further developments of the Cardano Blockchain can now be approved. Not only that but with this system, token holders can vote about ideas and proposals and their funding from the treasury.

DASH has implemented this system very successfully. Important points in such a system are a fair voting mechanism and voting incentives. In addition, it requires a simple way to submit ballots.

Cardano is very interested in Dash’s model and is working on a solution implementation of Liquid Democracy and an incentives treasury model which considers the participants in a balanced way.

Another point is to determine the direction in which the project and the cryptocurrency should move today and in the future. Usually, this is done either with a hard fork or a soft fork. In the first and second-generation cryptocurrencies, there is no canonical way to decide which fork is the right one to be followed.

Cardano draws an analogy here to the Constitution permitting adaptations. This prevents what happened with Bitcoin and Bitcoin Cash or Ethereum and Ethereum Classic.

A constitution remains stable but allows adaptations. the process to enforce a fork is clearly described, systematic, and time-consuming, and allows voting on ratification.