In this part, we will focus on Ripple. I would like to start by reviewing the pain points of today’s payment systems related to cross-border payments.

I will illustrate this with a recent experience of my own.

A few months ago we were supposed to make a money transfer due to a purchase to Brazil. At first, this does not sound so complicated. But the price had to be paid in BRL and BRL is not a freely tradable currency. The amount was in a size range where a change in the exchange rate can have a significant impact.

Since the Brazilian currency BRL is not freely tradable, at least in our country, it was not possible to buy the currency or hedge the currency. In addition, the Ukraine war was already underway and inflation was warming up, to say the least.

Our bank could offer the following 2 options.

Option 1: We send the amount in USD to Brazil and the beneficiary bank would credit the USD amount to the beneficiary account on the corresponding day X at exchange rate Y in BRL.

- Risk, unknowns?

- X and Y,

- Costs: Only the costs of the own bank were so far known, what could additionally still result, nobody can say exactly. Not even the own bank.

- Transparency: It was not entirely clear how the money transfer would be done and what all would be necessary or might come up.

Option 2: We instruct the bank to make the currency exchange and transfer BRL directly to the beneficiary bank. This is then done through the correspondent bank.

- Risks, unknowns?

- Y, this is because the cutoff time to enter the payment is 2 days before the execution of the exchange. The Rate taken by the correspondent bank is not known. However, the rate will then be known on the day of the transfer.

- Costs: The cost is higher than in Option 1, but still does not guarantee a liability. Fees charged by the correspondent bank are also unknown as the bank takes a margin by giving a lower exchange rate. This rate can be between +/- 0 to +/-4 or even +/- 5%.

- Transparency: It was not entirely clear how the money transfer would be done and what all would be necessary or might come up. In our case we had to provide additional information and this had as result that the execution date of the transaction was postponed. By the way we were not actively informed that some information was missing.

Now we had chosen the more expensive option 2 and wanted to ensure that the amount transferred in BRL is known and we are not exposed to unwanted surprises in the case of a change by the beneficiary bank when choosing option 1.

Well, the thought behind it was good especially due to the current situation in Ukraine and inflation, but the surprise was unfortunately very big. If we had chosen option 1, we would have probably gotten off a lot better.

The correspondent bank applied such a bad exchange rate that we finally lost about 25’000 BRL (approx. 5500 USD) compared to option 1.

This personal experience shows a few challenges with cross-border payments and existing payment systems. Namely: Transparency, costs, complexity, delayed settlement, …

This is why blockchain topics and crypto projects such as Ripple or fintech companies are so interesting. They can provide solutions for many challenges in the financial world and help to get better services for the consumer.

Ripple Labs and XRP

Ripple first appeared with XRP in 2012 and was founded by Chris Larsen, and Jed McCaleb. Ripple is a payment network based on an open-source protocol (XRPL, XRP-Ledger).

Ripple’s goal, among others, is to change the way money moves across national borders. For this purpose, XRP, Ripple’s own cryptocurrency and native digital asset is used. According to Ripple, this means that money can be moved across national borders faster and cheaper than with any other cryptocurrency and today’s cross-border payments systems. The aim is to ensure a high standard of safety and to eliminate prefunding bank accounts. Ripple also aims to solve problems such as ensuring a level playing field for all financial institutions.

This also applies to those institutions that do not have the necessary funds parked in bank accounts worldwide. Funds that are needed to ensure settlement and with that the possibility to do money transfers. Thus, Ripple also helps the unbanked with access to financial services.

XRP

Is a pre-mined token with a max. supply of 100’000’000’000 XRP’s. The Tokens were created in 2012, with 20 billion going to members of Ripple. In 2017 Ripple placed 55 billion XRP in escrow to ensure certainty of total XRP supply. During a 55 months period, every month 1 billion tokens will be sold to users. Every end of a month unsold tokens will be returned to the account for disbursement after the distribution period ends.

Some Facts & Figures about XRP

- Speed: Transactions settle on XRP Ledger in 3-5 seconds

- Costs: Transaction fees cost $0.0002 per transaction on average

- Scalability: XRP Leder consistently handles 1’500 transactions per second 24×7

- Stability: 70M closed ledgers

- Sustainability: 61’000x more efficient than proof-of-work blockchains

- Distribution: 150+ validators on a global network decentralizing XRP-Ledger

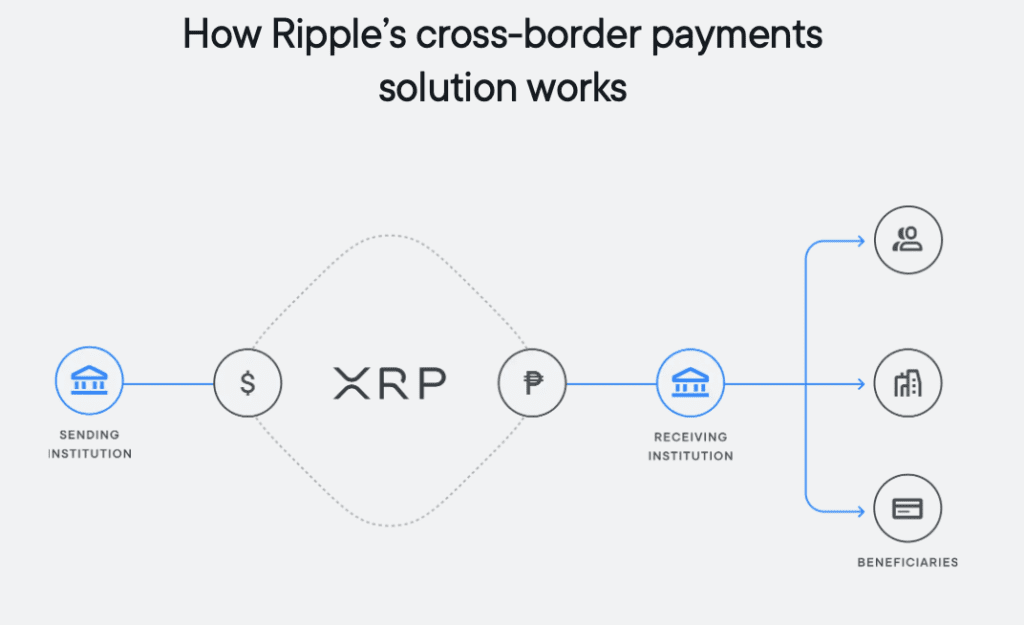

But How does it work?

For example, sending Institution needs to do payment from a USD account in the USA to a Pesos account in Mexiko for a beneficiary in Mexiko. The exchange from USD to XRP and then from XRP to MXN can be done in less than 3 seconds and then credited to the beneficiary account. In this case, there is no settlement delay, missing transparency, and lower costs for everyone.

XRP-Ledger (XRPL)

Forms the backend infrastructure and is not designed as a consumer product (although theoretically possible). This public database contains an integrated distributed currency exchange that operates as a global universal translator for money and other values. XRPL as a real-time distributed protocol can be used for anything that also has value.

The ledger is currency independent and the algorithms always find the best way to transfer values. It is possible to convert USD to JPY as well as bonus miles to Bitcoin. At this point, ILP should be mentioned again. Interledger is an open protocol suite that is used for sending payments via different ledgers/blockchains.

Ripple played the key role in the development of this protocol and has ensured that development continues under the umbrella of the W3C (World Wide Web Consortium).

XRPL use cases can be found in the following areas:

- Asset custody

- Payments

- Gaming

- Crypto Wallet storage

- Non-Fungible Tokens (NFT’s)

- Central Bank Digital Currencies (CBDC’s)

Consensus Mechanism

Is based on XLPR and anyone who accesses it, can view the most recent state of the network as well as any transactions. Consensus principles and rules are based on agreement, trust, correctness and forward progress. Every participant on the Ripple network selects a validator which is a server configured for participating in the consensus process. Each server uses its validators to agree upon the sets of transactions that should be included in the ledger. Consensus is achieved when a large enough percentage of Servers agree on transactions that should be approved. As long as 80% of the trusted validators agree the ledger moves forward. If it is below 80% the network does not move forward.

Product offering

Ripple currently offers 4 products to customers. xCurrent and xRapid services have been integrated into one platform called RippleNet.

xCurrent: Enterprise software that enables banks to instantly process cross-border payments with end-to-end tracking. Banks check in with each other in real-time to confirm transactions and their delivery. A rulebook ensures operational consistency and legal clarity for each transaction.

xRapid: Suitable for minimizing liquidity costs. Payments to emerging markets often require pre-funded accounts in local currency around the world. xRapid dramatically reduces capital requirements for liquidity. In doing so, XRP is used to offer the on-demand liquidity already explained above.

xVia: Is aimed at businesses, payment providers and banks that want to send payments across different networks via a standard interface. xVia’s simple API requires no software installation and allows users to seamlessly send payments worldwide with visibility into payment status and with rich information such as invoices attached.

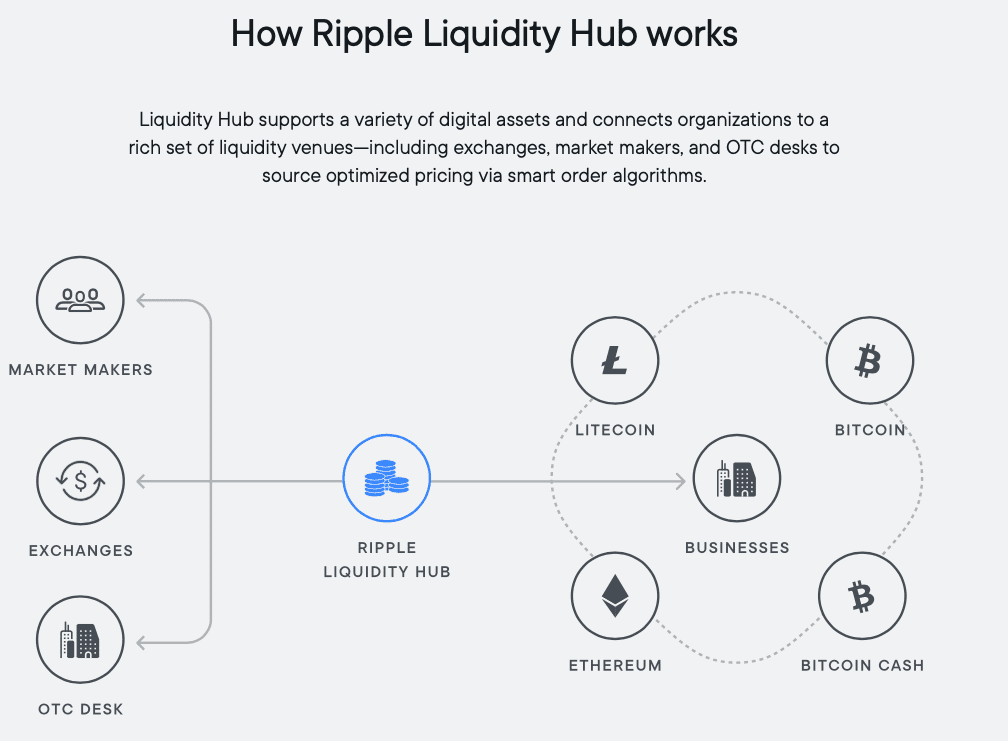

Liquidity Hub: 2021 Ripple announced the launch of Liquidity Hub, which is planned for 2022. The B2B concept is intended to enable other financial services providers to offer cryptocurrency trading to their customers. Ripple refers to a future in which companies will have a strategy for using cryptocurrencies, tokenized assets, smart contracts and more. It is also about the transfer of such assets and trading.

Designed as a turnkey solution for financial institutions, Ripple Liquidity Hub uses intelligent order routing to source digital assets at optimized prices from market makers, exchanges, and OTC desks. Firms will use Ripple Liquidity Hub to easily and seamlessly enable their end customers to buy, sell and hold digital assets at the best possible prices across a range of trading venues.

Ripple Liquidity Hub will uniquely solve the specific problems of enterprise customers by avoiding lengthy and resource-intensive integrations through a streamlined API and – unlike most other offerings – eliminating pre-funding requirements to free up working capital.

Central Bank Digital Currency (CBDC):

For some time now, the topic of digital currencies created via central banking has been discussed in the crypto sector, and some countries have already launched initiatives. These projects aim to create electronic money that is held directly in central bank accounts and is available to a wider range of users than the current digital form of monetary base for commercial banks.

Ripple offers a complete platform for minting, managing, and destroying CBDC’s.

Conclusion

From the beginning, Ripple has pursued a clear use case in crypto space, which lies in the cooperation with the financial industry and services for many parties in the future to be improved and cheaper. Topics around the discussion of whether Ripple is 100% decentralized or not as well as the SEC VS Ripple lawsuit and the proof that XRP is a security or a utility token have not changed the fact that Ripple’s business and use case has found great appeal in the financial services scene.

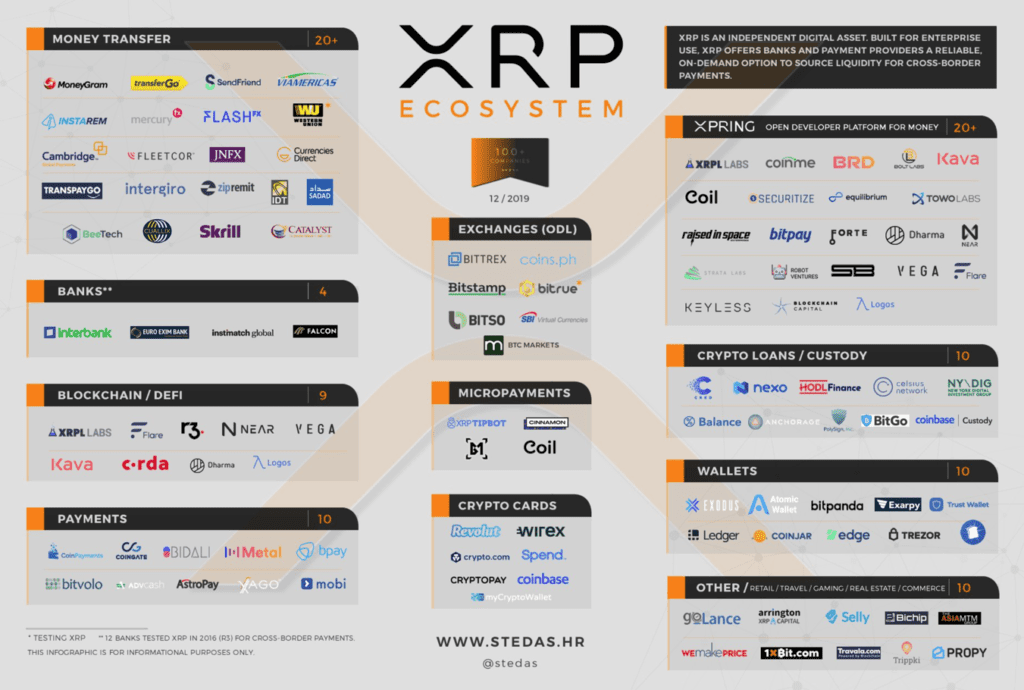

This can only be seen from the customers or partnerships entered into, which are represented by illustrious names such as:

In addition, you can read the complete listing under the following link (with built-in search filter) Ripple ecosystem

One thing is clear, however, disruption in the payments service provider market is one of the most competitive markets of all and giants like SWIFT or other providers are always looking to improve their services and bring them to market. Regulatory topics such as KYC etc… were not explicitly explored in the two articles, but are to be expected in such a highly regulated area as the financial world. Security is not written in capital letters in the financial world for nothing.

There was also no look at the numerous other projects in the crypto area, even if they are in similar areas. Very high TPS can also be achieved with other projects or they are in the process of becoming more closely involved with payment transactions. However, this could provide the basis for one of the next articles. Who knows?

The presentation of other initiatives (e.g. Xpring,…) that Ripple also pursues and promotes was also not addressed, as we wanted to present Ripple in its USE CASE as a possible SWIFT and PSP alternative.

Links

- Ripple

- Marketdata

- Ripple Labs and its Products Part 1/2

- XRP community blog

- Infographics Ripple

- XRP BLOG of Hodor